Price-Discrimination

Degree of Price-Discrimination

Pigou’s concept of ‘Degrees of price discrimination’ refers to the extent to which a monopoly firm. Can appropriate (or take away) the consumers surplus from the consumer and add to its own profits. The discriminating monopolist is able to take away party or whole of the consumer surplus by charging a lower price in the more elastic sub-markets. The extent to which the monopoly firm can appropriate the consumer surplus has been referred as the degree of price discrimination.

Its degrees are as follows:

-

Price discrimination of the first degree:

It is also known as perfect price discrimination. Price discrimination of the first degree occurs when the monopolist is able to sell each separate unit of the commodity at a different price. In this case the seller takes from the buyer the maximum price which he is willing to pay rather than go without the good altogether. Consequently. Practised by doctors and lawyers who collect different fees from customers depending on their ability to pay.

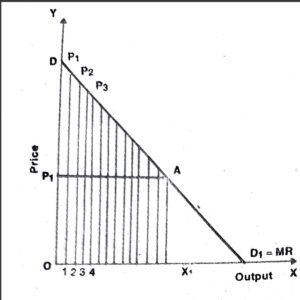

Price discrimination of the first order is also demonstrated with the help of fig.

In fig. DD1 is the market demand curve. The monopoly term negotiates for each unit with each buyer and charges the maximum price as indicated by each point on the demand curve. The first unit will be sold at a price of p1 the highest price possible under the prevailing demand conditions. The second unit will be sold at a price of P₂, the third at P3 and so on. The price of each successive unit becomes the marginal revenue for the monopoly firm thus the demand curve of the monopoly firm. (D1= MR). First degree price discrimination is a limiting case of price discrimination.

-

Price discrimination of the second degree:

In this type the seller divides his market into different groups of buyers. From each group of buyers a different price is charged by the seller. The price which the seller charges for each group is that which the marginal buyer is just willing to pay. Price discrimination of second degree leaves some consumers surplus to the buyers. The classification first and second classes is an excellent example of (ii) Price discrimination of third degree: Within this seller classifies his market into different sub – markets. For each sub-market the seller fixes a different price based on the elasticity of demand in different sub-markets. This position is explained in figure.

The monopolist sells the same quantity in all the three sub-markets, but charges OP price in one market, OP1 in the second and OP2 in the third market based on elasticity of demand.

The major limitation of this classification by Pigou is that he has focussed allocation of good to the sub-markets without caring to classify the consumers.

Essential conditions of Price Discrimination

-

Difference in elasticity of demand:

Price discrimination is profitable only when elasticity of demand in one market is different from elasticity of demand in the other. If the elasticity of demand is the same in two markets, it will not pay the monopolist from price discrimination.

-

Discrimination firm should be monopolistic:

Price discriminating firm should be a monopolist under perfect competition price discrimination is not possible. Price discrimination under other forms of market conditions like imperfect competition is possible only of there is some written or secret understanding among firms regarding price of the product.

-

Markets should be segregated :

Price discrimination is possible only if it is not possible to transfer the consumer in the low priced market to the consumer in the high priced market the two types of market should be segregated from each other

-

Restriction on Entry:

It should not be possible for the buyers in the dearer market to transfer themselves into the cheaper market to buy the goods at lower prices. Due to this condition a doctor is able to charge higher fees ‘rom rich customers.

-

Purchasing power of the consumer:

Price discrimination becomes more easy where the purchasing power of consumers varies. A lawyer can easily charge higher fees from a rich client.

-

Transport cost :

Discrimination often results when the markets are situated in distant places which makes transport costs prohibitive. Similarly, when the Government imposes tariff barriers the monopolist gets protected market where he can charge high price in the foreign market he will be selling at a lower price than at home.

Important links

- Traditional Theory of Costs- Short-run & Long-run

- Perfect Competition- Definition, Equilibrium firm & Conditions

- Equilibrium of an Industry in the short remand Long-Run

- Equilibrium of Monopoly- Short & Long Period Equilibrium

- Dumping- Meaning, Purpose, Price Determination etc.

- Monopoly- Definitions, Features, Classification etc.

- Equilibrium under Discriminating Monopoly

Disclaimer: wandofknowledge.com is created only for the purpose of education and knowledge. For any queries, disclaimer is requested to kindly contact us. We assure you we will do our best. We do not support piracy. If in any way it violates the law or there is any problem, please mail us on wandofknowledge539@gmail.com