Hofer’s Matrix: (Corporate Strategy Analysis Technique)

Hofer’s Matrix

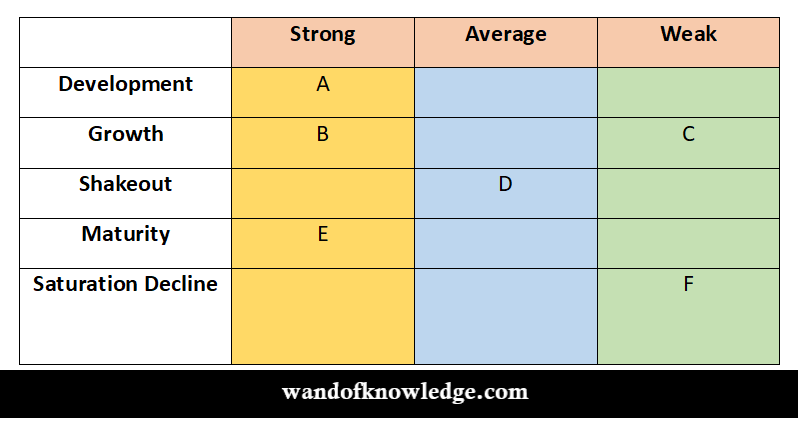

Hofer criticizes the BCG matrix because it inadequately represents new businesses in new industries that are just starting to grow. Hofer offers an extension of BCG analysis that remedies that inadequacy. Hofer analyzed businesses in terms of their competitive position and stage of product-market evolution.

Circles represent the size of the industries involved. The pie wedges within the circles represent the market shares of the firm. Hofer suggests that these be plotted for present and future businesses. Strategic choices based upon such a scheme might follow the logic below:

Exhibit: Business Strength-Industry Attractive Matrix

Business A seems to be an emerging star, and thus a target for excess resource allocation-especially to strengthen its competitive position in light of its strong market share.

- Business B might follow much the same scenario as business A, but corporate resource allocation would probably be contingent on determining why B has been unable to obtain a higher market share, given its strong competitive position, and on the presentation of sound plans to rectify that deficiency.

- Business C and D are question marks, though C is a strong candidate for retrenchment.

- Business F and, to a lesser extent, business E represent cash cows within the corporate portfolio and would be key targets for corporate resource generation.

- Business G appears to be an emerging dog, managed to generate short-term cash flow and targeted for eventual divestiture or liquidation.

Hofer’s approach can be a useful tool to aid the thinking of strategists in multiple- SBU firms who are considering alternative strategies for their various SBUS. Even within a single SBU with multiple products and/or markets, the approach can aid the thinking about the desired portfolio.

An Assessment of Corporate Portfolio Analysis:

Hill and Jones point four main flaws with of the portfolio planning techniques:

- An assessment of a business in terms of only the two dimensions of market share and industry growth can be misleading as a number of other factors need to be taken into account.

- The relation between relative market share and cost saving is not directly proportional. Companies with a low market share but focused on a market niche could have a low operations cost.

- A high market share in a low-growth industry does not necessarily result in the large positive flow.

- None of the portfolio planning techniques pays attention to the source of value creation from diversification strategies. They treat business units as independent, whereas they are linked to the corporate headquarter to share skills and competencies.

Managements do not pay adequate attention to the process of managing a large diversified company. They consider that success is simply a matter of putting together the right portfolio of businesses, whereas in reality it comes from managing a diversified portfolio to create value.

Important links

- BCG Matrix as Corporate Portfolio Analysis Technique

- GE Nine-Cell Planning Grid: Corporate Strategy Analysis Technique

- TOWS Matrix: (Corporate Portfolio Analysis Technique)

- Models of Strategic Decision Making

- Strategic Business Unit (SBU)- Success Factors, & Features etc.

Disclaimer: wandofknowledge.com is created only for the purpose of education and knowledge. For any queries, disclaimer is requested to kindly contact us. We assure you we will do our best. We do not support piracy. If in any way it violates the law or there is any problem, please mail us on wandofknowledge539@gmail.com